What Is Considered Office Equipment For Taxes . Equipment is considered more permanent and longer lasting than supplies,. business equipment is tangible property used in a business.

from www.chegg.com

Income subject to tax ('taxable income') $. how do you know whether an expense should be considered an office supply or an office expense? business equipment is tangible property used in a business.

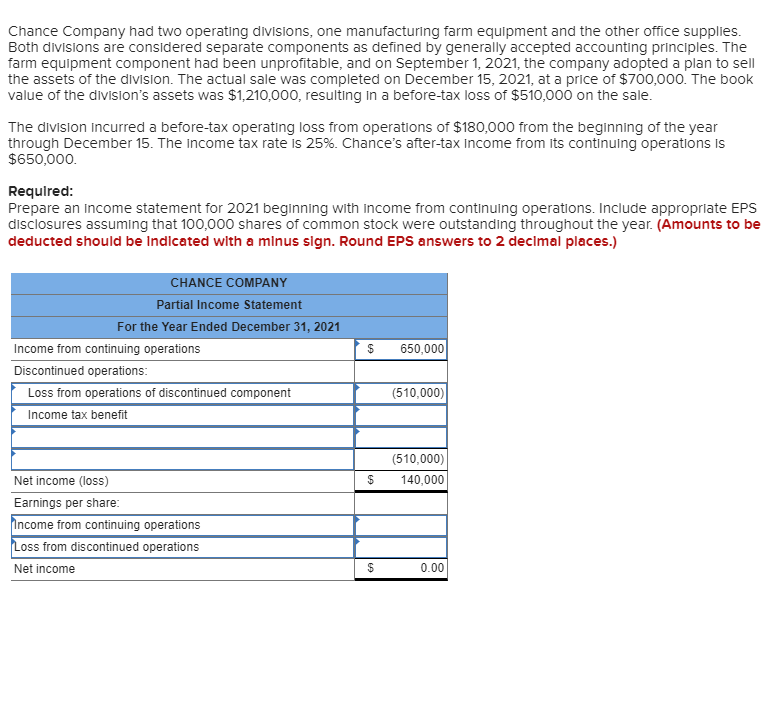

Solved Chance Company had two operating divisions, one

What Is Considered Office Equipment For Taxes business equipment is tangible property used in a business. Equipment is considered more permanent and longer lasting than supplies,. business equipment is tangible property used in a business. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for.

From www.businesswomenin.org

Best Office Equipment for a New Businesswoman Business Women In What Is Considered Office Equipment For Taxes how do you know whether an expense should be considered an office supply or an office expense? Income subject to tax ('taxable income') $. business equipment is tangible property used in a business. Generally, you have to account for gst. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000. What Is Considered Office Equipment For Taxes.

From pxhere.com

Free Images money, business, cash, save, calculator, savings, taxes What Is Considered Office Equipment For Taxes Equipment is considered more permanent and longer lasting than supplies,. Generally, you have to account for gst. you can deduct office supplies or equipment on your business tax return if you are able to show that they are. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. business. What Is Considered Office Equipment For Taxes.

From www.market-inspector.co.uk

10 Basic Office Equipment (2024 Guide) Market Inspector What Is Considered Office Equipment For Taxes you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Generally, you have to account for gst. business equipment is tangible property used in a business. how do you know whether an expense should be considered an office supply or an office expense? Income subject to. What Is Considered Office Equipment For Taxes.

From www.chegg.com

Solved Chance Company had two operating divisions, one What Is Considered Office Equipment For Taxes Generally, you have to account for gst. business equipment is tangible property used in a business. you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Income subject to tax ('taxable income') $. Equipment is considered more permanent and longer lasting than supplies,. What Is Considered Office Equipment For Taxes.

From pxhere.com

Free Images writing, work, pen, brand, cash, font, calculator, taxes What Is Considered Office Equipment For Taxes Income subject to tax ('taxable income') $. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. business equipment is tangible property used in a business. how do you know whether an expense should be considered an office supply or an office expense? Generally, you have to account for. What Is Considered Office Equipment For Taxes.

From www.outlookmarketingsrv.com

August = Office Supplypalooza! What Is Considered Office Equipment For Taxes this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. business equipment is tangible property used in a business. you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Generally, you have to account for gst. Income subject. What Is Considered Office Equipment For Taxes.

From www.anyrgb.com

Tax collector, Australian Taxation Office, service Tax, taxpayer, goods What Is Considered Office Equipment For Taxes business equipment is tangible property used in a business. how do you know whether an expense should be considered an office supply or an office expense? you can deduct office supplies or equipment on your business tax return if you are able to show that they are. this means, if you earn $35,000 but spend $4,000. What Is Considered Office Equipment For Taxes.

From imgbin.com

Tax Day PNG, Clipart, Calculator, Office Equipment, Tax Day Free PNG What Is Considered Office Equipment For Taxes Equipment is considered more permanent and longer lasting than supplies,. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. how do you know whether an expense should be considered an office supply or an office expense? Income subject to tax ('taxable income') $. business equipment is tangible property. What Is Considered Office Equipment For Taxes.

From www.bartleby.com

Answered Statement Of Cost of Goods Manufactured… bartleby What Is Considered Office Equipment For Taxes Generally, you have to account for gst. you can deduct office supplies or equipment on your business tax return if you are able to show that they are. business equipment is tangible property used in a business. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. how. What Is Considered Office Equipment For Taxes.

From www.pinterest.com

hair salon monthly expenses Google Search Tax deductions, Tax What Is Considered Office Equipment For Taxes this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. Equipment is considered more permanent and longer lasting than supplies,. Generally, you have to account for gst. Income subject to tax ('taxable income') $. business equipment is tangible property used in a business. What Is Considered Office Equipment For Taxes.

From zuoti.pro

The following information is available for Shanika Company for 20Y6 What Is Considered Office Equipment For Taxes you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Generally, you have to account for gst. Equipment is considered more permanent and longer lasting than supplies,. Income subject to tax ('taxable income') $. business equipment is tangible property used in a business. What Is Considered Office Equipment For Taxes.

From www.indiamart.com

SASCO Office Equipment Currency Counting Machines, Automation Grade What Is Considered Office Equipment For Taxes business equipment is tangible property used in a business. how do you know whether an expense should be considered an office supply or an office expense? Income subject to tax ('taxable income') $. you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Equipment is considered. What Is Considered Office Equipment For Taxes.

From pxhere.com

Free Images writing, hand, white, money, business, save, calculator What Is Considered Office Equipment For Taxes you can deduct office supplies or equipment on your business tax return if you are able to show that they are. business equipment is tangible property used in a business. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. how do you know whether an expense should. What Is Considered Office Equipment For Taxes.

From www.chegg.com

Solved 1. Considering both employee and employer payroll What Is Considered Office Equipment For Taxes Income subject to tax ('taxable income') $. Generally, you have to account for gst. business equipment is tangible property used in a business. how do you know whether an expense should be considered an office supply or an office expense? Equipment is considered more permanent and longer lasting than supplies,. What Is Considered Office Equipment For Taxes.

From online-accounting.net

What are operating expenses? Online Accounting What Is Considered Office Equipment For Taxes this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. Income subject to tax ('taxable income') $. Generally, you have to account for gst. you can deduct office supplies or equipment on your business tax return if you are able to show that they are. business equipment is tangible. What Is Considered Office Equipment For Taxes.

From www.anyrgb.com

Taxation, tax, valueadded Tax, invoice, article, office What Is Considered Office Equipment For Taxes you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Generally, you have to account for gst. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. business equipment is tangible property used in a business. how. What Is Considered Office Equipment For Taxes.

From fortmi.com

Office Equipment Meaning, Types, Importance, Uses And Care Of Office What Is Considered Office Equipment For Taxes you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Income subject to tax ('taxable income') $. this means, if you earn $35,000 but spend $4,000 on office supplies, your profit will be $31,000 for. Generally, you have to account for gst. Equipment is considered more permanent. What Is Considered Office Equipment For Taxes.

From lookoffice.vn

Summary of Necessary Equipment for the Office » LOOKOFFICE.VN What Is Considered Office Equipment For Taxes how do you know whether an expense should be considered an office supply or an office expense? you can deduct office supplies or equipment on your business tax return if you are able to show that they are. Equipment is considered more permanent and longer lasting than supplies,. business equipment is tangible property used in a business.. What Is Considered Office Equipment For Taxes.